APRIL JUNE 2009

COMPLIMENTARY WITH THE FINANCIAL EXPRESS

MICROFINANCE

AN INSIGHT INTO THE WORLD OF MICROFINANCE

W O R L D

The Success of

Microfinance in India

The Success of

Microfinance in India

Page

4

The success of microfinance in India

Page

9

Microinsurance market in India

Page

10

`Let's now ask banks who is credit-worthy: the rich who

don't pay back or the poor who do'

Interview with Muhammad Yunus, Grameen Bank

Page

13

Outreach should broaden

Page

14

Small is profitable

Page

15

Microinsurance: A snapshot

Page

16

Grain banks and self help groups

Page

19

Leading the way

Page

20

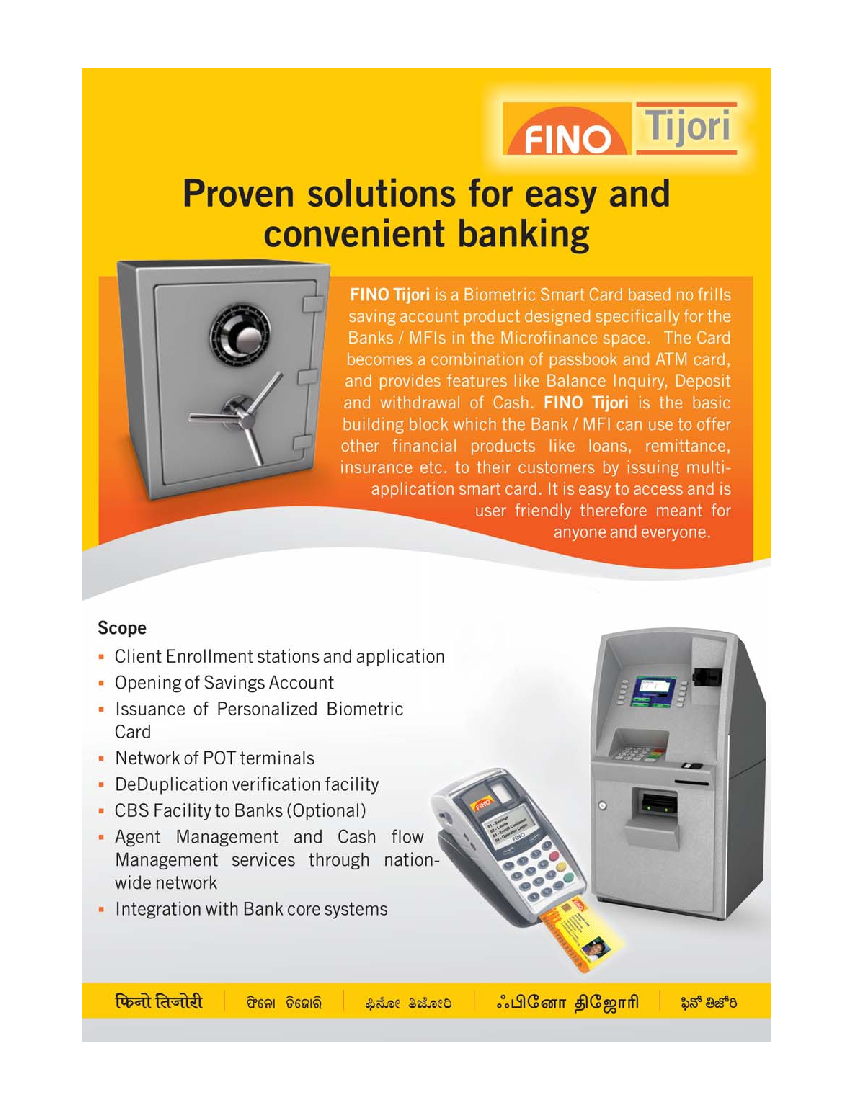

`We have been growing at 200%. By 2009 end we should

have over 60-65 lakh customers'

Interview with Suresh Gurumani, CEO, SKS Microfinance

Page

23

The Impact of financial crisis on microfinance

Page

25

We are concentrating in direct SHG Bank Linkage

Programme to reach out to more SHGs directly

Interview with MS Sundara Rajan, CMD, Indian Bank

Page

26

`MFIs, if linked with livelihood, have a very crucial role

to play in the growth of the economy'

Interview with Ela R Bhatt, founder of SEWA

and Sa-Dhan

Page

28

`Our efforts in the new fiscal year will be focused around

customers and competencies'

Interview with AP Ghugal, GM, Priority Sector Credit

Department, Bank of India

Page

30

Models for achieving financial inclusion in India

Page

32

Towards inclusive growth

MICROFINANCE WORLD | April 2009

2

[

CONTENTS

]

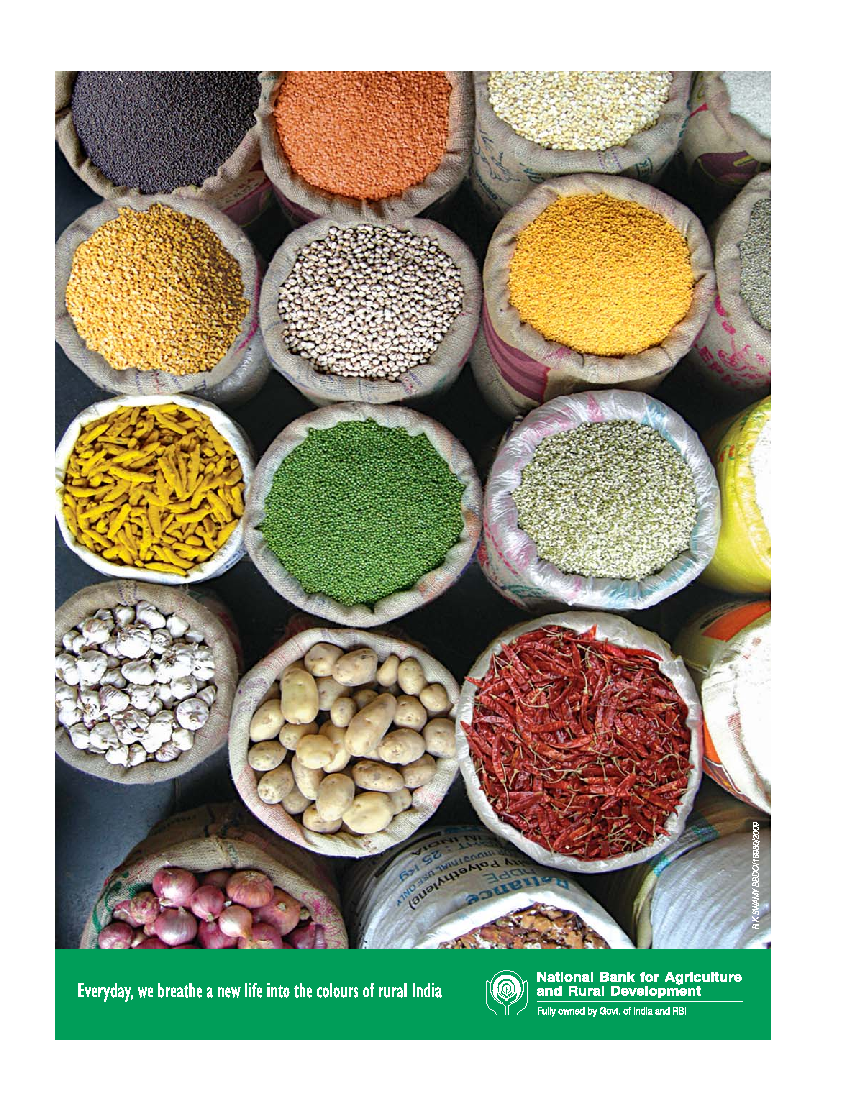

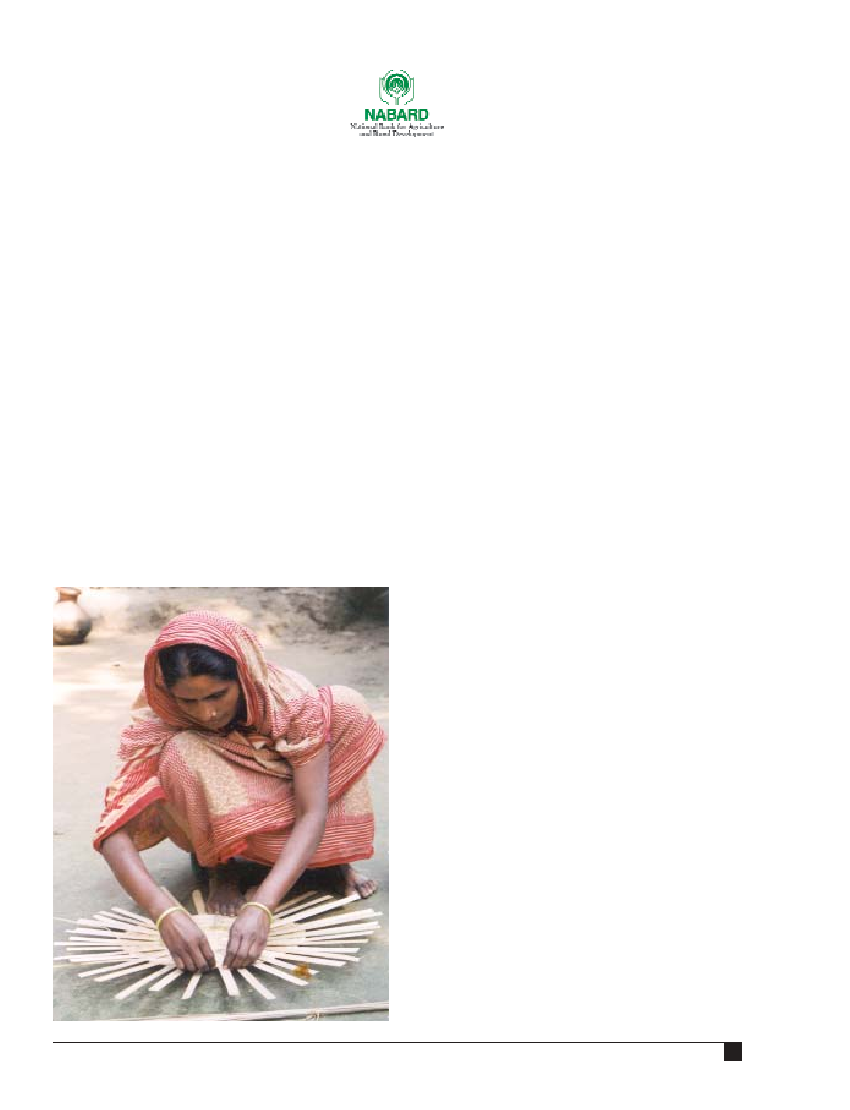

Cover photograph: Sandipan Majumdar, Kolkata/CGAP

Microfinance Photography Contest

CONTENTS

April 2009 | MICROFINANCE WORLD

3

[

FOREWORD

]

CONSULTING EDITOR

M

ONALISA

S

EN

monalisa.sen@expressindia.com

DESIGN

A

NOOP

K

AMATH

SPECIAL PROJECTS TEAM

G. S

UBRAMANIAN

g.subramanian@expressindia.com

2nd floor, Express Towers,

Nariman Point, Mumbai 400 021

Tel: 022- 22022627 Ext: 389

Fax: 022- 22022639

PRODUCTION

B.R. T

IPNIS

General Manager

Copyright: The Indian Express Limited. All

rights reserved. Reproduction in any manner,

electronic or otherwise, in whole or in part,

without prior written

permission is prohibited

A SPECIAL PROJECTS INITIATIVE

HOW TO REACH US

We prefer to receive letters via email,

without attachments. Writers should disclose any

connection or relationship with the subject of

their comments. All letters must include an

address and daytime and evening phone

numbers. We reserve the right to edit letters

for clarity and space.

Mail: Monalisa Sen

Email: microfinance@expressindia.com

MICROFINANCE

WORLD

The Indian Express Limited

2nd floor, Express Towers,

Nariman Point, Mumbai - 400 021

M

icrofinance is evolving and the coming years will

see it making a definite impact across rural and

urban India giving hopes and opportunity to mil-

lions to raise their standard of living. There are success stories

to suggest that its intervention is not a poverty alleviation

measure. But coupled with appropriate framework micro-

finance could lead to sustainable and profitable economic

activity as well.

As per the Global Environmental Monitor, small and

medium enterprises powered by microfinance contribute

significantly to the economic growth of the society. For

microfinance to be an effective tool to spur economic growth,

it is believed that micro-loans need to be used more for enter-

prise building at the bottom segment of the pyramid. In

Bangladesh, about 15 million families now benefit from small

loans and other financial products such as micro savings and

microinsurance. It has resulted in 40% of the overall reduc-

tion of rural poverty.

However, not all microfinance intervention leads to

economic activity although millions of people around the

world have been taking benefit out of it. Reports have shown

that a substantial portion of the microfinancial services are

used for consumption or for a mix of consumption cum

enterprise building activities.

Over the years the dynamics of financial inflow to the

microfinance sector has undergone radical changes. Started

with grants and soft loan fund to take up small microfinance

intervention, now large institutions are tapping huge capital

funds from global equity investors. The whole range of invest-

ment instruments like equity, debt, soft loan, revolving fund,

grant money and other institutional support funds are now

available to the microfinance institutions.

The diverse models and approaches have helped in reach-

ing out to new regions and to populations which have

remained excluded from financial services. The government

should ensure transparency and full disclosure of rates

including fees.

M

ONALISA

S

EN

Consulting Editor

DEAR READER,

ASHOK B SHARMA

D

elivery of credit at the doorstep of those who are

not covered by the formal banking business, cou-

pled with capacity building, is one of the ways for

achieving financial inclusion. Such a financial inclusion of

the poor can be more fruitful if the credit disbursed can

help them become entrepreneurs than meeting only their

consumption needs. The process can also be accentuated

if the disbursing microfinance institutions (MFIs) incul-

cate a habit of savings by attracting deposits and come out

with insurance products covering various risks.

The Nobel Laureate from Bangladesh and the founder of

the Grameen Bank movement, Muhammad Yunus, has

termed the microfinance disbursement as "a social busi-

ness" in contrast to the commercial business of banks and

financial institutions. There should be a separate regulatory

authority for MFIs as distinguished in character from that

for the commercial banks. The regulatory authority for MFIs

should evolve guidelines keeping in view the objectives of

socio-economic development of the poor, he suggests.

According to Yunus, MFIs should be self-sustaining, be

allowed to attract deposits, provide insurance and pension

fund, and should be capacity building.

THE SUCCESS OF

MICROFINANCE IN INDIA

Financial inclusion of the poor can only be possible if the MFIs inculcate a habit of

savings and come out with insurance products covering various risks

MICROFINANCE WORLD | April 2009

4

[

COVER ST

ORY

]

Grameen Bank meeting

HTTPWWWFINOCOIN

4EL

If MFIs are owned by borrowers, there should be no pay-

ment of licence fees. MFIs can source funds from banks.

He is, however, not in favour of MFIs sourcing funds from

outside the country. Funds should preferably be mobilised

and distributed locally, he opines.

The interest rates should preferably be lower. MFIs

should ultimately be owned and operated by borrowers, as

is in Bangladesh. There should not be any scope for individ-

ual profit in MFIs. All profits should be ploughed back in the

MFIs for meeting the costs of transactions, he suggests.

According to Yunus, this is the right time for the micro-

finance movement to grow and spread in India. It can

counter the adverse impact of the cur-

rent global financial crisis and provide

jobs and self-employment to many.

He holds the global banking and finan-

cial institutions responsible for the cur-

rent global economic crisis as they have

befooled the investors via mere paper

transactions. "Banking regulations

should clearly distinguish between gam-

bling and business. There should be

proper in-built mechanism to prevent the

business from running into trouble and

insurance schemes should be in place for

protecting deposits. The government

should not bailout these institutions by

doling out public money," he says.

The microfinance institutions should

cater to the `real economy' and livelihood

of millions of poor. The developing coun-

tries like India and Bangladesh have been

largely insulated from the adverse impact

of the current global financial crisis due

to the presence of the `real economy', he

says. In Bangladesh 80% of the poor are

covered under microfinance. The remain-

ing 20% are expected to be covered with-

in the next two years.

India has been able to cover only 20%

people under it and needs to speed up,

he suggests.

In India, a Bill for regulation of MFIs is

pending in Parliament since 2007. The

proposed legislation has been delayed

on the issue of lowering of interest rates.

A joint secretary in the banking division

of the finance ministry, Amitabh Verma,

says the government is very keen on

MFIs lowering their interest rates. The

MFIs should carry out their operations without any sub-

vention of interest rates by the government. Bangladesh

has set up a regulatory authority for the Grameen Banks

and another legislation for approval of MFIs as social

banking institutions is pending for approval.

Citing a few instances of social business, Yumus said,

students in Bangladesh were given loans, most of who

have opted to become entrepreneurs after they completed

their studies. Interest-free loans of 1,000 taka were given to

1,00,000 beggars, 15,000 of which have stopped begging

and set up small business. Loans without any interest was

an exception in case of beggars. As a general principle,

MICROFINANCE WORLD | April 2009

6

[

COVER ST

ORY

]

MFIs should charge interests on loans to cover their trans-

action costs. Prudence suggests that cost of transaction

should be minimised and interest rates should be kept low.

MFIs in India, however, allege that their interest rates

are higher (mostly in double digits) as they have to cover

the costs of transactions and capacity building.

According to Amitabh Verma, bank's refinance rates to

MFIs are not likely to be less than 7%. Also, the govern-

ment may not be in a position to render subvention on

loans. Therefore, the MFIs should find novel ways for

covering or hedging their costs.

MFIs apex body Sa-Dhan's executive director Mathew

Titus said; "The microfinance sector in India is going

through a difficult and a challenging phase. Extraordinary

growth, global credit crunch and increased awareness of

social impact pose a challenge. It is an opportune moment

for house keeping and clearing up concerns that have

been around for a while. Growth and competition need to

be addressed in the common spirit to serve the poor.

Transparency is the key property that microfinance must

subscribe to."

Microfinance in India touched the 33.6 million clients-

mark in 2007-08, of which 14.1 million were served by

MFIs, according to Sa-Dhan estimate. Other estimates put

the client outreach at over 100 million. These estimates

may differ but there is an unanimous acknowledgement of

the fact that over 90 million low-income households still

remain unserved. Therefore, microfinance must grow

steadily and steeply. All indicators point to a flattening

growth curve. However, these were computed before the

global financial crisis and the growth path may even suffer

a dent, according to some experts. This means not only

unserved clients will have to wait longer but also the exist-

ing clients are likely to see their credit flow slowing down

and shrinking.

There is no possibility of a steep growth from grant

financing at this stage. In a given period, grants are just

not large enough. The same holds true for profits that, in

theory, can be generated from a granted corpus. If profits

are huge enough, the organisation would either cease to

be a community development finance by charging in

excess of traditional moneylenders or serve non-poor

clients. Savings could be a very feasible option, particular-

ly in the long run. Only cooperatives are legally entitled to

mobilise savings. Some of the experiences suggest failures

of cooperatives. However, cooperative legislations in sev-

eral states like Andhra Pradesh led to reforms in the coop-

erative model. The outcome is the legal form of MACS,

which is the registration for many SHG federations.

There are about 75,000 SHG federations functioning in

India and are an important avenue for managing an ever-

expanding number of SHGs. The SHGs federate into a two

or three-tier structures and take up a range of services,

both financial and non-financial. They have so far not

been included formally into the SBLP and have strong

points in their favour like cost efficiency and democratic

governance. Besides lacking exposure to these relatively

new organisations, bankers often raise concerns about

level of professionalism of federation management, viabil-

ity of the business model including dependency on the

self-help promoting institution (SHPI) and political inter-

ference. The idea of a national-level SHG federation is

being debated to address the issue.

Bankers are generally comfortable in extending re-

finance to the non-banking financial companies (NBFCs)

because equity serves as a lever for credit. Banks are usu-

ally concerned over the creditworthiness of MFIs and SHG

federations' portfolio quality, profitability, governance and

viability of the business plan. Incidentally, the involve-

ment of investment funds regularly brings about improve-

ments in all these areas. Bankers rely more on existing sys-

tems and structures, though some emphasise on the mer-

its of a long-term relationship, their loan terms are mostly

24 to 36 months. Therefore, it is essential that MFIs and

SHG federations go for credit ratings. Meanwhile, Nabard

has a scheme for subsidised credit rating for MFIs and

SHG federations.

However, microfinance can grow from the perspective

of demand only if adequate resources flow to MFIs and

self-help groups (SHGs). There are four main options for

capital mobilisation -- grants, profits, savings and invest-

ment. Grants and profits, however, are unfeasible.

MICROFINANCE WORLD | April 2009

8

[

COVER ST

ORY

]

"Banking regulations should clearly distinguish between gambling

and business. There should be proper in-built mechanism to

prevent business running into trouble. There should be insurance

schemes for protecting deposits. Government should not bail out

these institutions by doling out public money."

Muhammad Yunus, founder of the Grameen Bank movement

April 2009 | MICROFINANCE WORLD

9

[

COL

UMN

]

MONICA AGRAWAL

M

icroinsurance aims to provide

protection and inculcate the sav-

ings habit for the customers at

the bottom of the pyramid. Some time in

their lives, most people experience finan-

cial difficulties with potentially long lasting

results. This is especially true for the poor

in developing countries. Any natural

calamities and disasters to the poor are

considered to be the severely shocking haz-

ards, which is hard for them to recover

from. There is therefore a growing realisation of the need

for microinsurance products in our country.

It represents an untapped market of nearly $2 billion in

India alone, according to a study released by the United

Nations Development Programme (UNDP). Demand for

microinsurance in India has remained low in a large part

because of a severe mismatch between services offered by

insurers and the needs of the insured. The present out-

reach of microinsurance is around 5 million people, cover-

ing only 2% of the poor in the country.

Challenges

Microinsurance delivery in India is fraught with chal-

lenges. A major hurdle is the acceptance of microinsur-

ance among the rural poor who not only have low levels of

awareness about possible risks to their lives but also lack

trust in most financial schemes structured for the long

term with no immediate benefits. Non-availability of

authentic admissible documentation during enrollment

and claims processing and a lack of facilities for premium

remittance further adds to the complexity in insurance

administration in the remote and far-flung pockets of

India. Despite the numerous challenges, insurance com-

panies have in the recent past made significant inroads to

take insurance to the masses at the bottom of the pyramid.

Microinsurance at Aviva

Our Vision statement for the Microinsurance Business

Vertical is "To cover risks to the lives and

livelihoods of the poor and underprivileged

at an affordable cost." Aviva has been pro-

viding insurance to protect the lives and

livelihoods of the economically weaker sec-

tions of society in partnership with organisa-

tions such as Basix, Aarohan and Paras Cap

Fin. Today, we cover more than 1.5 million

lives and have settled close to 6,000 claims.

We have a well established microinsurance

practice focussing areas such as customer

friendly products customised to the LIG seg-

ment needs; affordable and lean processes

to cater to the unique dynamics of this segment; world class

customer service experience and demonstrated capability

in claims settlement.

We have been developing microinsurance products in

consultation with our distribution partners. Our popular

microinsurance products include Credit Plus, Credit

Suraksha in the group category and Grameen Suraksha for

individual lives. Credit Suraksha and Credit Plus are cred-

it-linked products largely for MFIs and SHGs. Grameen

Suraksha, on the other hand, is a traditional term plan

under which the policyholder pays a premium for a period

of two years and avails an insurance cover benefit for

either 5 or 10 years. The minimum cover available is

Rs 5,000 and the maximum is Rs 50,000. Additional flexi-

bility is also offered such that the customer continues to

be covered for an extended period of 18 months (for the

five-year plan) or 48 months (for the ten-year plan) even if

she or he is unable to pay the second annual premium.

Summary

The microinsurance market has seen a lot of activity in the

recent past and new customer service standards are being

set in a market that has long been sidelined for its non-

profitability and complexity. However, a lot of ground

needs to be covered before we see tangible results in terms

of increased insurance penetration and adequate risk cov-

erage for the rural poor.

The writer is Director Corporate Initiatives, Aviva India

MICROINSURANCE

MARKET IN INDIA

The risk coverage to the poor will help them to recover from natural calamities

In the new financial crisis, how different will the role of

micro-credit banks be?

Micro-credit is not impacted by the financial crisis for the

simple reason that it is not exposed to the international

financing system. Micro-credit is close to the real people.

That is one of its strengths. Another strength is that we

don't borrow from the international market--it is local

money going to local people. Third, while the convention-

al banking system is collapsing, micro-credit has a high

repayment rate that is based on no collateral and no legal

papers--it functions beautifully. So, today, we can raise the

same old question we raised 32 years ago when banks told

us that the poor are not credit-worthy: who is credit wor-

thy? The poor are the ones who are paying back and it is

the rich who are not paying back. The crisis has allowed

the world to challenge the financial system. I am in favour

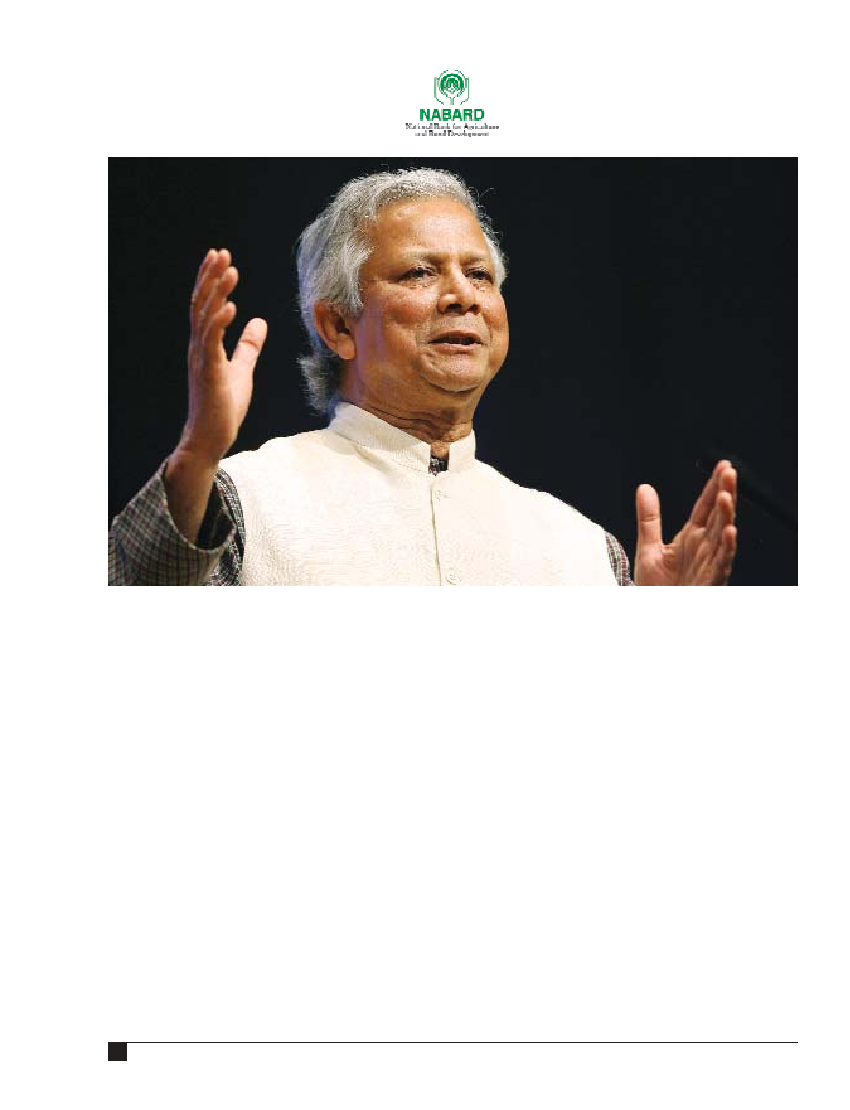

`LET'S NOW ASK BANKS WHO IS

CREDIT-WORTHY: THE RICH WHO DON'T

PAY BACK OR THE POOR WHO DO'

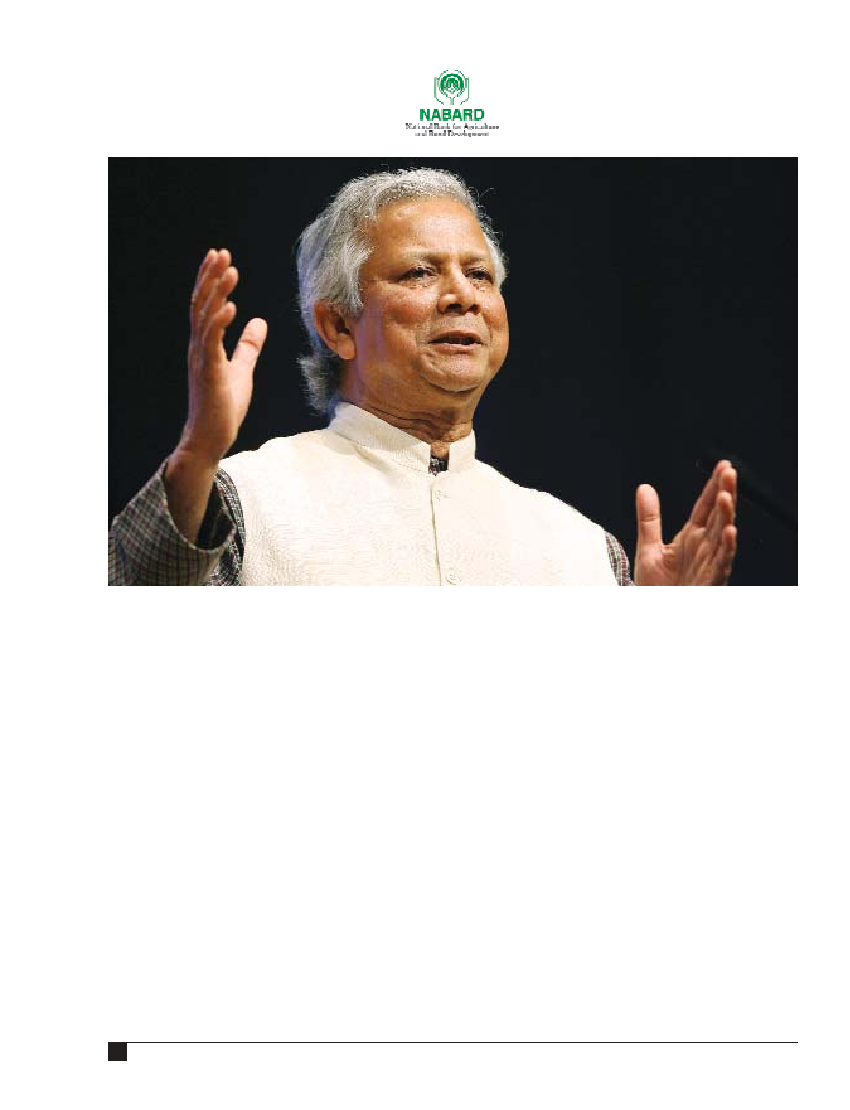

With his Grameen Bank, Muhammad Yunus, winner of the Nobel Peace Prize,

redefined the concept of lending. In an interview with FE, Yunus speaks about the

current economic crisis and explains the role of micro-credit banks in dealing with

poverty. Excerpts:

MICROFINANCE WORLD | April 2009

10

[

INTERVIEW

]

Bloomberg

of redesigning it and redoing it. Going back to the same

system would be the worst kind of mistake we can make.

Of course, terrible things are happening but we should

look at this as a great opportunity.

Farmers complain that there are too many checks and

balances when they approach banks and financial

lenders for loans but the same checks evaporate when

banks lend to big business houses.

Interest rates in micro-finance should be as low as possi-

ble because we are not in the business for money. The idea

is to help people out of poverty as fast as we can. In micro-

financing, we give loans to the poor--without collateral

and without any legal instruments--for income-generat-

ing activity with the lowest possible interest rate. That is

micro financing.

Does the potential of micro-financing end once people

are above poverty line or does it have the potential to

take them even higher?

We make entry into micro-credit very difficult, unless you

are extremely poor. We have a tough screening process--we

want to make sure we are getting to the person at the bot-

tom. So if you are a poor person who lives in two-room

house, please wait, we are looking for people who live in a

single room. Once you qualify, you will never be denied. You

can become the richest person in the world but we can still

fund you because you had qualified and now you are an

example for us. You will inspire others; you are the owner of

the bank--Grameen Bank is owned by the borrowers. No

one has to leave, everyone can stay as long as they wish.

How well does the system work?

It is very strong. If you are successful and I am not as suc-

cessful, I copy you and see if I can benefit from that. It hap-

pens a lot. For example, we encourage everyone to send

their children to school--100 per cent of the children of

Grameen families are in school. They want to make sure

that their children go as high as possible and Grameen

Bank gives them a student loan. Right now, there are more

35,000 people with student loans from the Grameen Bank

in business schools, medical schools, engineering schools.

So you inspire each other. That is the advantage of having

groups, having weekly meetings and so on.

What is the legal position on NGOs' lending capacity?

If an NGO wants to lend money to poor women, the law

can come and say you are under arrest, you are violating

the law because in order to lend money, you have to be a

moneylender, registered under the Moneylenders Act or

you have to be a bank. For example, if you take people's

savings and then disappear, who will stop you when you

are not registered? NGOs who are doing good work as

micro-credit organisations should be given the status of a

micro-credit bank. You can give them standardised inter-

est rates so that it is transparent.

People ask me, why don't you convert yourself into a

bank? I say this is a ridiculous proposition. Banking law is

created to create big banks. These big banks are like cargo

ships. A micro-credit bank is like a dinghy boat that goes

into shallow water, ferries a little merchandise. You cannot

construct a dinghy boat from the architecture of an ocean-

going vessel. This is the difference. Why don't we make the

architecture of a dinghy boat--what is so difficult about it?

Grameen Bank has a law that applies to it, it is a specialised

bank. We say, why don't you generalize this law so that any-

body can begin a Grameen Bank in Bangladesh? Millions

and millions of people need financial service. This is a busi-

ness but a business with a completely different purpose--

to help people create their own employment. In the context

of this financial crisis, this becomes more important

because people will be losing their jobs, will be losing liveli-

hoods. So if you can create financial systems of micro-cred-

it, they can create self-employment opportunities.

The India government has used the loan waiver as a

means to address issues of poverty. Your experience has

been that micro-credit borrowers are extremely good

repayers. Is there a clash between the two models?

Politicians are not bankers. They want political solutions.

Waiver is a political solution--it is a good way to ask for

votes but that is not a financial system which is tenable.

Once you waive a loan, you are not only doing harm to the

present cycle but you are giving incentives to people in

future not to repay and pressure the government to waive

loans. If I have to waive a loan, I would do it by giving them

cash--because if you borrow, you have to pay back. That is

the culture we have to build, otherwise the banking system

will not work. Bangladesh is a country where disasters are

April 2009 | MICROFINANCE WORLD

11

[

INTERVIEW

]

The crisis has allowed the world to challenge the financial system. I am in favour of

redesigning it and redoing it. Going back to the same system would be the worst kind

of mistake we can make. Of course, terrible things are happening but we should look

at this as a great opportunity

frequent. Many families start from zero after floods but we

never waive their loans. The standard practice at Grameen

Bank is that as soon as the disaster hits, the branch is con-

verted into a humanitarian organisation. All banking

activities cease to exist. Once the crisis is over, we take care

of these families, help them start some kind of activity to

keep them working. We issue new loans, new houses.

Slowly, you pay back. We take your loan and convert it into

a long-term one. Our system is that no matter how long it

takes to pay back the loan, the interest can never exceed

the total principal. Our policy is to make sure people get

back on their feet. If people are not on their feet, the bank

will not be on its feet.

Does your bank have something for the urban poor?

When I was drafting the law for Grameen Bank, I put in a

provision that this bank will never work in any urban

centre. Now, we are asking the government to amend it

because we have already covered the villages of

Bangladesh. Only the cities are left. In rural areas, we now

have 7.7 million borrowers--97% women. Basically, this

is a bank for poor, illiterate women--they own the bank.

Our board is made up of their representatives, chosen

by them.

How do you see Grameen activities in India?

There is no Grameen Bank in India, just a Grameen-type

programme because there is no law to allow this type of a

bank to be created here. Those that exist are restricted

since they cannot take deposits. Most of the time they run

around for funds rather than concentrate on the work.

Grameen Bank can grow as each branch is dependent on

the deposits it can mobilise from the area and lend the

money to the local people. A Grameen Bank branch is like

an independent bank by itself. We want to build our own

capacities but because the law doesn't support this in

India there are limited capacities.

How did Grameen America, your New York venture,

come about and how does the model work?

It is said micro-credit cannot work in the United States

because it is a different country, a rich country, etc.

Grameen Bank started in USA in 1987 when as Governor

of Arkansas, Bill Clinton invited me. I had a meeting with

him and his wife Hillary Clinton. They were eager to

understand our work. He said we need this in Arkansas

because this is the poorest state in the US. That was the

beginning and Hillary Clinton was the chairman of the

committee running this bank. After he became President,

that programme was folded up. Then somebody from

New York wanted it there. So, last January, we launched it

in Jackson Heights. We deliberately chose Jackson

Heights because in Arkansas we had a lot of trouble giv-

ing loans to people. Their welfare law is funny: if you

somehow earn one dollar, you have to report it to the

welfare authority and welfare authority will diligently

deduct this dollar from your cheque. That is shocking. If

I were in charge of drafting this law, I would have done

just the opposite. So we wanted to choose an area where

welfare has not penetrated yet. We followed every single

principle of the Grameen Bank. Whatever you see in a

Bangladeshi village, you see in Jackson Heights. We sent

somebody from Bangladesh to start the programme and

we chose somebody who has never been to the United

States so that he does what he does in a Bangladeshi vil-

lage. He will not feel embarrassed about it. Today, we

have more than 5,000 borrowers, all women, some

Caribbean, some Latinos, some Indians. Repayment is

99.6% and while big banks are collapsing in the same

environment, this bank is flourishing. Now everybody

wants a Grameen programme. In Grameen Bank, the rule

requires that every borrower must open a bank account.

Whatever little money you earn every week, you deposit

that in the account. So to open an account for a woman

who saves two dollars a week was the greatest hurdle in

the entire project. We are getting a lot of invitations, even

one from Warren Buffet. His daughter Susan invited us to

Omaha, Nebraska, because Omaha is very poor.

Everybody is in the pipeline.

We often speak about `social business'. Can you explain

the concept?

The basic thing that went wrong in the current financial

crisis is that the capitalist system made the human being

appear as a uni-dimensional being and created a theory:

that all they do in their economic life is to make money. I

say, yes, making money is an exciting goal but human

beings are multi-dimensional beings. There are many

other things we take pleasure in doing--selflessness is

one. That is where we went wrong. Why don't we create

separate businesses on the basis of selflessness? If people

can give away, why not use the money to design a business

which helps people--say, something to tackle malnutri-

tion. So at the end of the year, instead of asking the com-

pany how much money it made, you would be asking how

many children it got out of malnutrition.

This financial crisis is an opportunity for us to incorpo-

rate the idea of social business. Money-making business

has failed the world. If we bring the social business into

the picture, some balance can be restored.

MICROFINANCE WORLD | April 2009

12

[

INTERVIEW

]

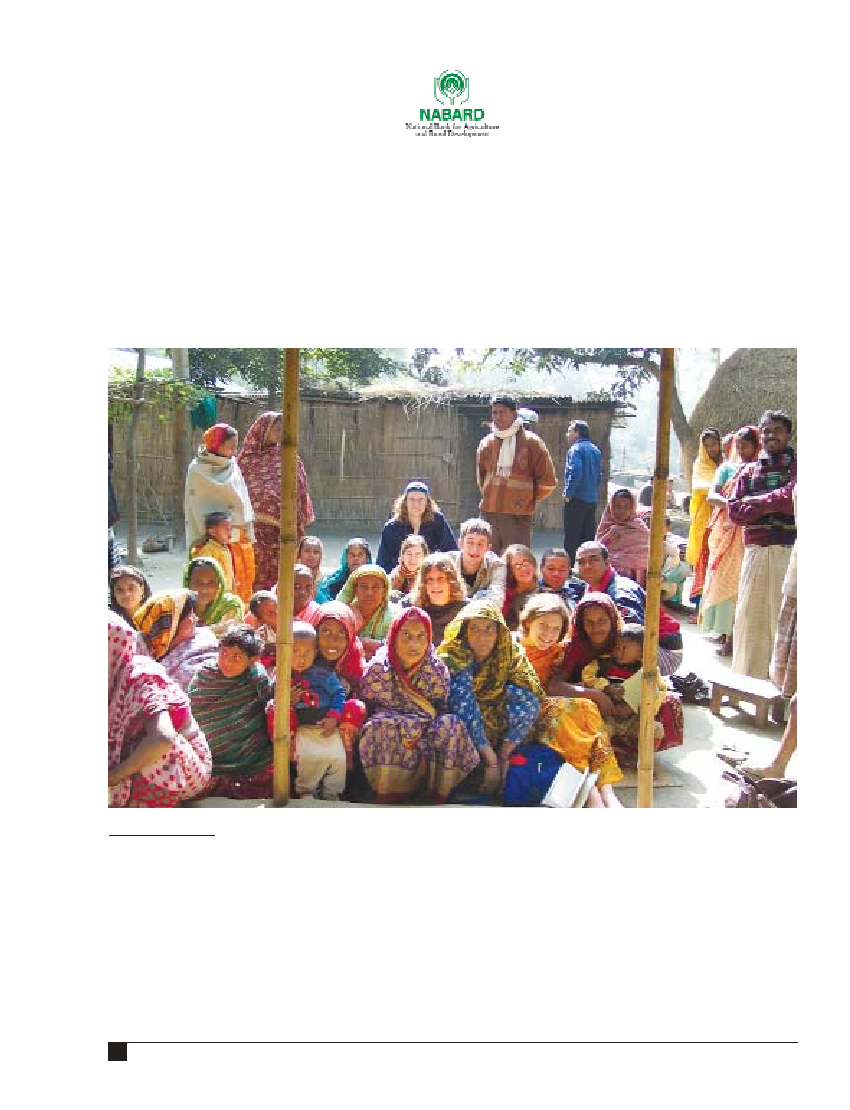

JENNIFER MEEHAN

T

welve months ago, in a candid

conversation with a mentor and

friend on the state of microfi-

nance for the poor in India, I heard a

comment that stopped me in my

tracks: India was in danger of declaring

microfinance a huge success while tens

of millions of poor families continued

to lack access to the most basic of

financial services.

No doubts, India is one of the most

dynamic microfinance markets in the

world. A combination of visionary social

entrepreneurs, huge demand for micro-

finance services and the availability of local commercial

debt capital (and in some cases equity capital) has fuelled

rapid and enviable growth in the sector. It is estimated that

almost 55 million households are currently being reached

by specialised microfinance institutions and through the

NABARD-supported self-help group approach.

Yet, for Grameen Foundation, growth in and of itself is not

a sufficient measure of the microfinance success. It is the

quality of growth, as well as the quality of the services being

provided that matters. Are the poor and poorest actually

being reached with financial services in a timely and honest

manner? Are those services designed to enable them trans-

form their lives?

These questions dominated the recent Sa-Dhan microfi-

nance conference in New Delhi, headlined by two global

leaders in microfinance, Muhammad Yunus of the Grameen

Bank in Bangladesh and Ela Bhatt of Sewa in India. These

two visionaries, along with social entrepreneurs across the

world, became barefoot bankers by accident--because of

its transformational impact on the lives of the world's poor-

est people.

We believe that financial and social success in microfi-

nance are not mutually exclusive, but rather mutually

dependent. Financial sustainability is required to grow

microfinance to the scale of the problem--global poverty--

and a measurable impact on lives is required to fulfill our

underlying purpose and mission.

Grameen Foundation first began working in India

almost a decade ago when many of

today's leading and fastest-growing

microfinance institutions were still

experimenting with different solutions.

There are three trends in India that give

us pause for thought: 1) there is

increasing anecdotal evidence that the

poor are not being served in large

numbers, especially in the North and

East 2) The micro finance institutions

that have accessed commercially ori-

ented equity financing are moving,

either consciously or not, away from

serving the poor who are more expen-

sive to reach, thereby reducing prof-

itability 3) There are a few MFI `biggies'

that dominate the microfinance market, leaving innova-

tive smaller and younger institutions to struggle to grow

in order to maximise their impact.

Over the next year, we will advance our double bottom

line agenda in India in three ways. First, by promoting

the missing piece of the double bottom line puzzle--

social performance in general and our Progress out of

Poverty Index (PPI) tool specifically. With this tool, we

can finally move beyond anecdotes and get verifiable

data whether the poor are being reached and how their

poverty levels are changing with access to microfinance

services. Second, we will--in collaboration with

Grameen Capital India--provide catalytic capital to Tier-

II institutions working with the poor in underserved and

unserved regions of India. And finally, we will collaborate

with practitioners and others locally to dispel the myth

that microfinance is only appropriate for those `econom-

ically active' poor at or around the poverty line.

In order to declare microfinance a success in India, not

only do tens of millions of more poor people need to be

reached, but those services must have a transformational

impact on their lives and those of their family members.

The writer is the CEO Asia Region for Grameen Foundation

(GF), a global non-profit organization that combines

microfinance, technology and innovation to empower the

world's poorest people, especially women, to escape poverty.

She is based in Hong Kong and can be reached at

jmeehan@grameenfoundation.org

OUTREACH SHOULD BROADEN

Ensuring microfinance continues to work for and is focussed on the poor in India

April 2009 | MICROFINANCE WORLD

13

[

COL

UMN

]

SUSHILA RAVINDRANATH

I

t is not very apparent yet, but one of India's fastest

growing businesses is microfinance. In India, the

organised microfinance industry is about ten years old.

The most popular model for these institutions is the

Bangladesh-based Grameen Bank. The micro entrepre-

neurs usually want to start ventures not amounting to

more than Rs 10,000. The interest they pay to the money

lenders make their borrowing completely unviable. For

example in the wholesale vegetable market in Chennai,

one can see people disbursing Rs 100 to various vegetable

vendors in the morning. By the evening the vendors have

to pay back Rs 120. This means they pay 20% interest every

day. These are the vegetable, flower, fish vendors, tea stall

and food stall owners who require funds and have no

recourse other than the money lenders.

The microcredit institutions (MCI) lend them this

amount without any security. The MCIs prefer to lend to

women rather than men. Some women give their borrow-

ings to men in their family. But they make sure it is

returned. In micro credit women make better borrowers.

The interest rates are not low. Instead of 50% charged by

the money lender it may be 38%. Still there is a saving. And

the default rate is negligible.

A survey conducted by RBI finds that most borrowers

say that it is easy or very easy to get a loan from microfi-

nance institutions (MFIs). They have a close monitoring

system which ensures that there are minimum defaults.

MFIs have a good recovery rate. District administration

received very few complaints against

MFIs. Almost all the bank branch man-

agers said that MFIs were good customers

of banks and they could be used as busi-

ness facilitators or correspondents.

However, microcredit is an operationally

difficult concept. According to people in

the business, if the loan amount is

Rs 5,000, the amount is collected over 50

weeks at Rs 120 per week. Usually five

women join together to take loans. It

becomes a collective liability. The field

development officer holds a meeting with all of them before

lending. Then the women pledge to pay back the amount

and the institution starts lending. The officer goes literally

everyday to follow up on the progress of a number of bor-

rowers for whom he is responsible. Each branch of the

institution has many such collection centres. Lending

radius is usually within one or two square kilometer. And

one has to get to know the people. Banks can never handle

something like this.

In spite of these hurdles there have been quite a few suc-

cess stories like SKS India which was launched in 1998. It is

one of the fastest growing microfinance organisations in the

world, having provided over Rs 6,212 crore and having

maintained loans outstanding Rs 2,216 crore to 3,906,007

women members in poor regions of the country. Borrowers

take loans for a range of income-generating activities,

including livestock, agriculture, trade (such as vegetable

vending), production (from basket weaving to pottery) and

new age businesses (beauty parlour to photography).

Spandana founded in 1998 is also one of the fastest

expanding microfinance institutions in the country. It is

also one of the most efficient in the country with an oper-

ating expense ratio of 5.5% on portfolio. It now boasts of a

client base that constitutes almost 1.5% of the BPL (below

poverty line) population of India. Then there is West

Bengal-based Bandhan, Chennai based Micro Credit

Foundation of India , all doing splendid work with women.

Once they are established MCIs can be channels for

other products like mutual funds, insurance and so on. It

is also possible to tie up these institutions with education

and healthcare. Now that several success

stories are emerging in this area, and the

spreads appear good, many larger com-

panies want to join the bandwagon. This

worries existing players. The big groups

they fear will push costs and salaries up

which will defeat the purpose of microfi-

nance. The industry also fears political

interference, government interfering with

interest rates and so on. Notwithstanding

some problems many firmly believe that

the future lies in microfinance.

SMALL IS PROFITABLE

Microfinance institutions have a close monitoring system which ensures that there

are minimum defaults with a good recovery rate

MICROFINANCE WORLD | April 2009

14

[

FEA

TURE

]

In microcredit

women make better

borrowers. The

interest rates are

not low. Instead of

50% charged by

the money lender it

may be 38%

TARUN CHUGH

I

t is widely recognised that microfinance

is a powerful tool in eradicating extreme

poverty. As outlined in the millennium

development goals under the United

Nations Development Programme, the

basic approach adopted by the signatories

is built on the premise that over the time,

with the support from the state govern-

ments, village economies can transition

from subsistence farming to diverse com-

mercial activity.

The role of microfinance institutions

The first step towards achieving this is the availability of

credit for asset creation. Over the last decade, the microfi-

nance institution (MFI) movement originating from the

Grameen model in Bangladesh has proliferated worldwide

and made a significant difference to the rural economy. In

India too, commercial insurers traditionally have focused

on bundling basic life risk products with the MFI loans to

increase reach and convenience for consumers. However,

credit linked insurance is usually driven by very low premi-

um. For instance, ICICI Prudential Life's Sarv Jan Suraksha

has a minimum premium of Rs 50 per annum and provides

up to Rs 30,000 in case of an eventuality. This sum is usual-

ly adequate to cover the loan outstanding and, hence, pro-

tect the earning asset for the family. The premium is gener-

ally paid by the MFI as an extended credit to the member

and recovered along with the loan installments.

Creating value for consumers beyond credit insurance

Availability of credit, however, is a necessary, but not suffi-

cient, condition for sustainable financial inclusion. Given

that the low-income group families in the developing

world are specifically vulnerable to multiple idiosyncratic

and catastrophic risks, income protection in these markets

is as important as income generation.

Microinsurance not just plays a key role in meeting the

credit requirements of this segment but at the same time

provides them protection against the above stated risks,

creating tremendous value for consumers in safeguarding

their interests.

Regulatory environment

Regulation in India has been fairly proac-

tive on the need for microinsurance. The

Insurance Regulatory Development

Authority (IRDA) was the world's first regu-

lator to come up with specific microinsur-

ance guidelines in 2005.

Reaching out to the consumers

Microinsurance is no longer considered just

a subsidised business for meeting the IRDA

obligations. According to a UNDP report

published in 2007, microinsurance repre-

sents an untapped market of nearly $2 billion in India.

Consumer education

Consumer education on the need and importance of life

insurance at the community level in these markets is very

critical and needs to be carried out in isolation of advertis-

ing and promotion.

Product innovation

ICICI Prudential Life, for example, has designed a cus-

tomised product offering--Anmol Nivesh-- which is a sav-

ings and protection product designed exclusively keeping in

mind the need and income cycle of tea plantation workers.

Managing costs

Reaching out to this potential market needs to be cost

effective for it to be a viable business model for insurers on

a sustained basis. This makes it critical for various stake-

holders to pool in their resources towards achieving a

common objective. Pooling of data between insurance

companies and government bodies can help improve

actuarial calculations and in better pricing.

Public Private Partnerships

The Centre, as well as a few state governments, have taken

steps towards providing life and health risk cover to the

poor. One of the more popular ones--Rashtriya Swasthya

Bima Yojana--is now launched across the country.

The writer is Chief - Alternate Channels & Group, ICICI

Prudential Life Insurance Co. Ltd.

April 2009 | MICROFINANCE WORLD

15

[

COL

UMN

]

MICROINSURANCE: A SNAPSHOT

The life and health risk cover for the poor can contribute towards alleviating poverty

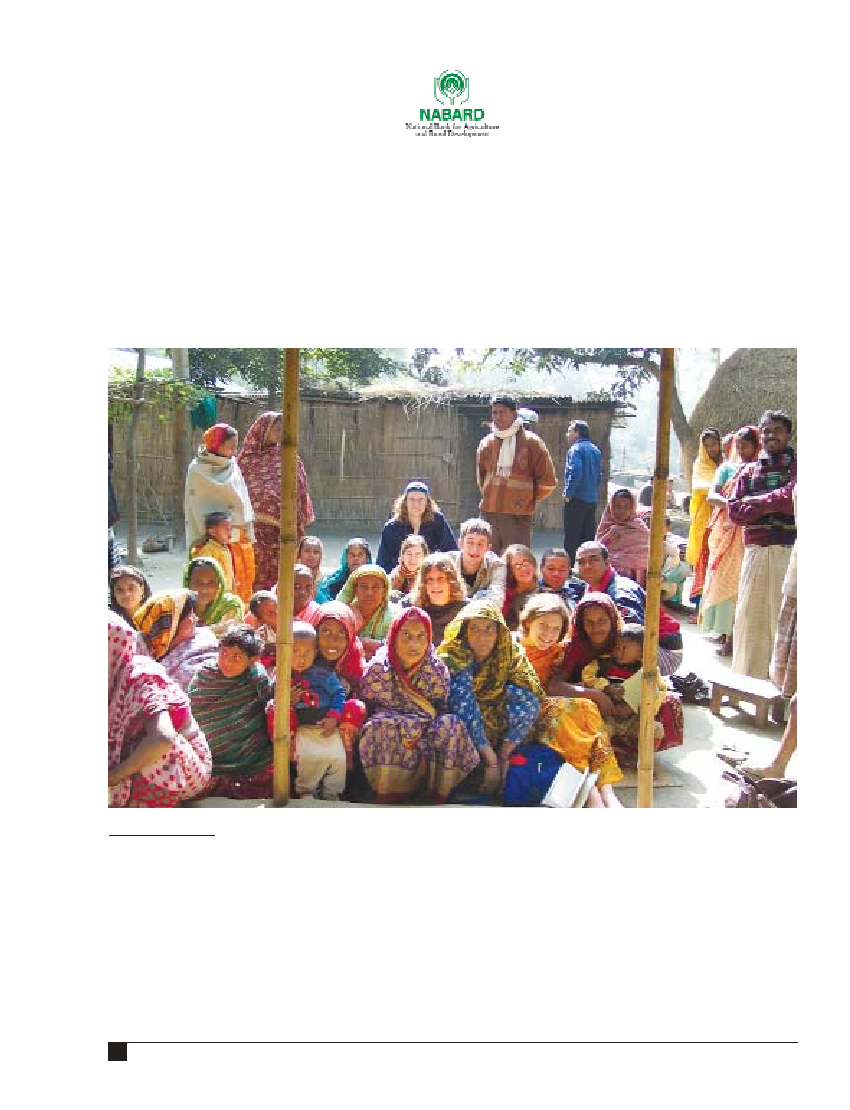

INDUMATI SAHOO

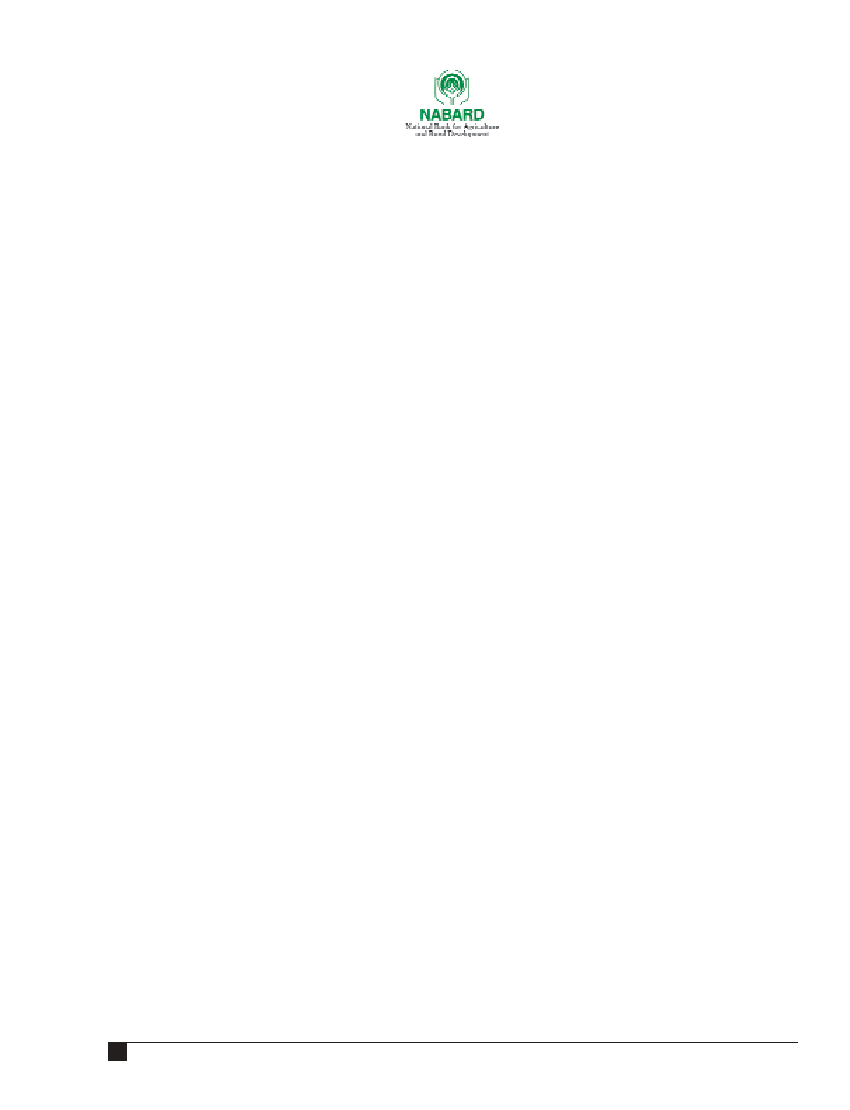

Grain Bank

Grain Bank is a kind of "Cereal Pooling Mechanism" at the

village level. The villagers contribute a portion of their own

harvested stocks of paddy, ragi and maize during December

and January to establish a village based fund in the form of

grains collectively to meet exigencies. The members of the

Grain Bank usually borrow during lean period during May

to September and repay the same along with interest in the

form of grains after next harvesting.

The concept of Grain Banks is quite popular among

many tribal and backward regions of the country. The

Grain Banks offer dual benefit to the members in the form

of food security as also the seed security depending on the

participating clients. They also offer a savings avenue to

the poor in the form of savings in kind.

With a view to synergise the concept of Grain Banks with

that of the Small help Groups (SHGs), two projects were

supported by NABARD, one each in Orissa and

Chhattisgarh with the following objectives:

a) To explore the possibilities of monetising the savings-

in-kind in the form of grains to explore the possibilities

of building synergy between SHGs in a village.

b) To understand the issues in participatory management

of Grain Banks in some of the dis-advantaged areas.

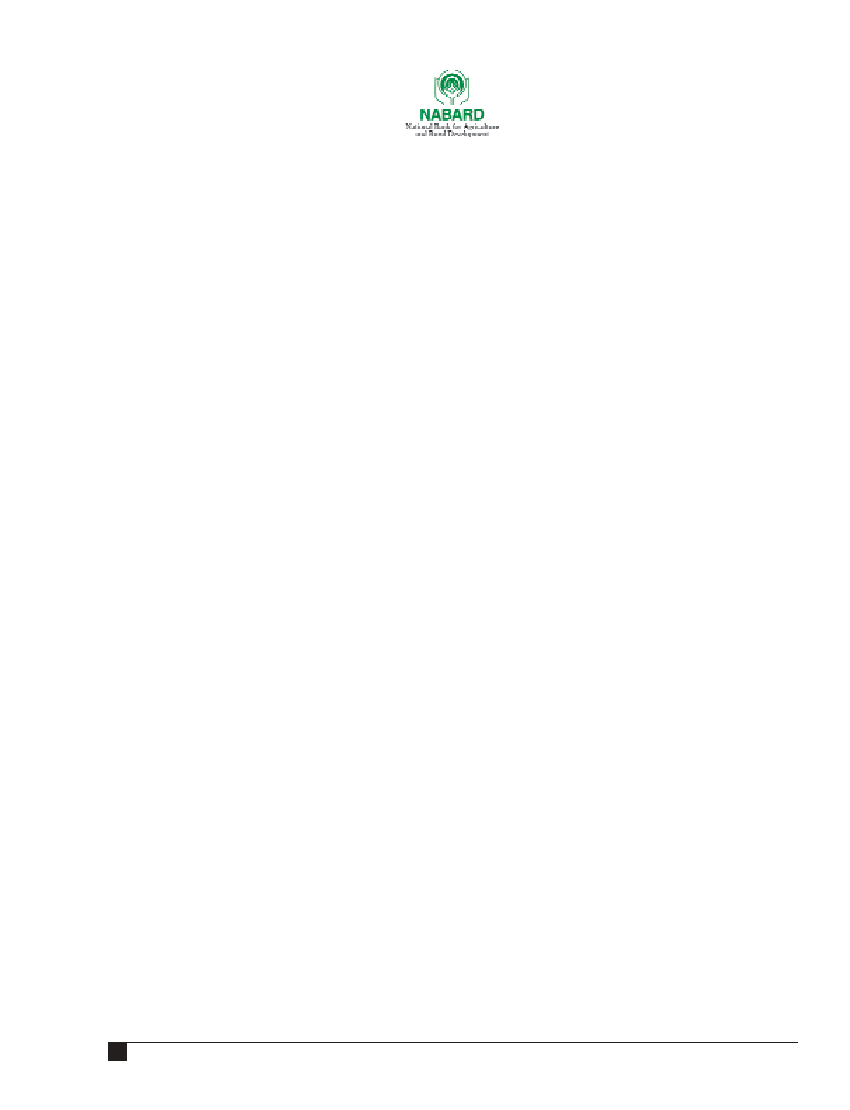

Orissa (Kalahandi district)

The Grain Bank project was piloted in the Rampur block of

the Kalahandi district with a mission of exploring the pos-

sibility of synergising the traditional practice of maintain-

ing grain banks with the SHG. The pilot envisaged mon-

etising savings in the form of grains by SHGs enabling

participatory management of grain banks by members

and securing the availability of food grains and seeds espe-

cially in the post monsoon period.

A total number of 17 villages of Thuamul Rampur block

of Kalahandi district were covered under the project. Out

of the 353 households in the 17 villages and hamlets, 263

belong to ST category, 42 to SC and 4 are of OBC category.

The land in this area is hilly land without irrigation facil-

ity. The livestock are mostly in the form of goats and cows.

The income level of most of the household is quite low.

It was observed that the food stress period is for about

nine months. The agricultural produce meets the food

requirement for only 2-3 months. A major portion of the

produce is used for liquidating the loan from the money-

lender. The lean season of food availability is from May to

September of the year and the food scarcity becomes

acute during rainy season. People get into the clutches of

the moneylenders during this period. The nearest bank

branch is at Gunupur about 25 km away.

Three Grain Banks were constructed in Silet, Sikerguda

and Maltipadar. All the three are in active operation in 17

tribal villages of Kerpai and Nakarundi GPs of Thuamul

Rampur block of Kalahandi district.

Three Grain Bank Committees were constituted with

members from different SHGs.

29 SHGs were promoted by the NGO, Antodaya.

SHGs started savings in cash and grain. Savings

mobilsed by the SHGs from members was Rs 1,59,025

and grain of 5,330 kgs (approximately).

The district administration took keen interest in imple-

menting and monitoring the project. SHGs have

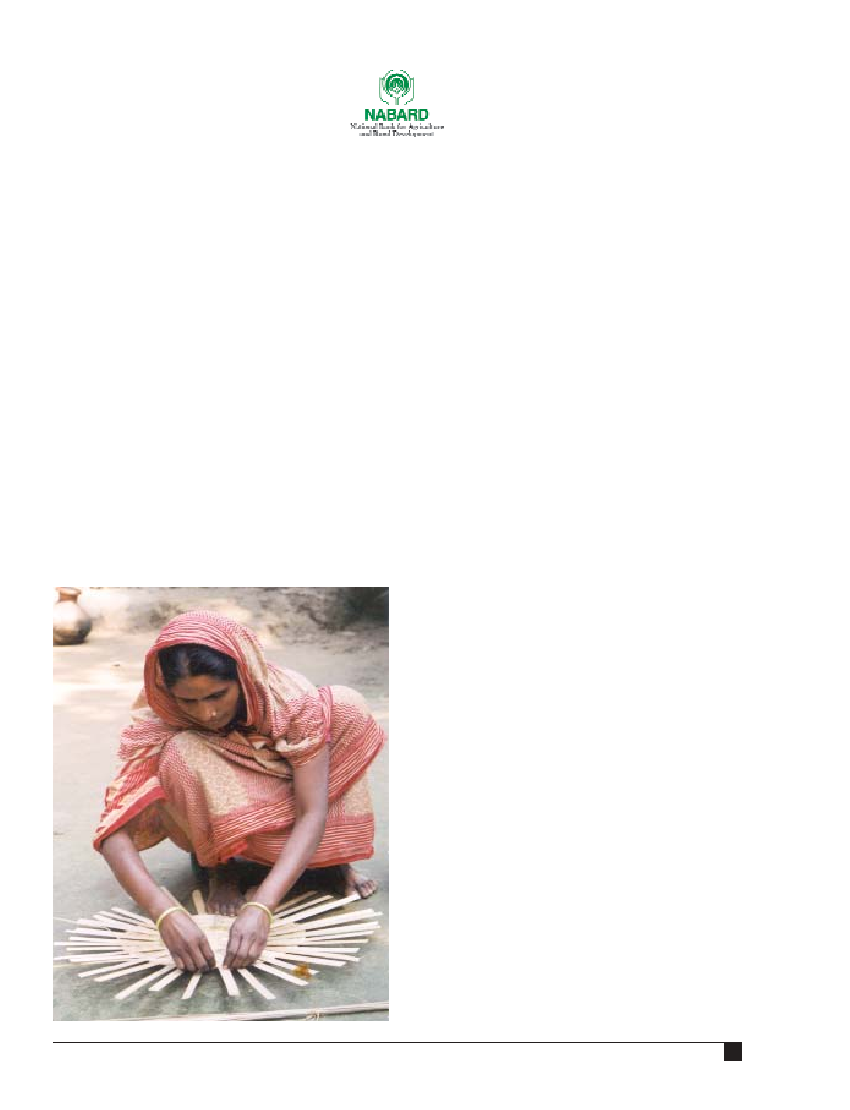

GRAIN BANKS AND

SELF HELP GROUPS

In Orissa and Chhattisgarh repayment and distribution in any mode of grain led to

converting the produce of the area into money thereby facilitating savings

MICROFINANCE WORLD | April 2009

16

[

COL

UMN

]

received support from external sources such as

Integrated Tribal Development Agency (ITDA) and

Orissa Tribal Empowerment and Livelihood Project

(OTELP) to an extent of Rs 1.45 lakh and Rs 1.5 lakh.

Cash in hand were to the extent of Rs 11,865, cash in

Bank were Rs 3,44,124 and the amount involved in inter-

nal lending were of Rs 1,36,642 by the end of May 2008.

Grains totaling 963 Kgs (rice, paddy, ragi and small mil-

let) have been saved by the groups. Kalahandi Anchalika

Gramin Bank provided loan aggregating Rs 3.75 lakh to

the groups.

Other benefits

The implementation of the pilot project for Grain Bank

among others highlighted the area so much that the

Government of Orissa selected it under Orissa Tribal

Empowerment and Livelihood Project (OTELP). The

micro watersheds are being developed and livelihood

programme are being implemented under the project.

Roads are being constructed to improve the connectiv-

ity. The flow of funds and the wages in the form of grain

and cash have facilitated better standard of living for the

people. The scarcity of grain has been reduced to a great

extent. But the people are keen to continue with the

Grain Bank as the OTELP project will be there for two

more years.

At the pre-development stage, about 97% of the families

were under food stress during 5-6 months and were

under the clutches of money lenders. In the post inter-

vention period no family was going to the mahajan or

the money lender for food grain during scarcity period.

For cash loan the bank linkage is proving adequate.

However, occasionally few families still go to money

lenders as the nearest branch is situated 40 km away

which gets cut off during monsoon.

People have gained confidence and can hold on to

their produce for a month or so by availing loan from

the SHGs. Last year they could sell kandul dal (wild

arhar) at higher price and sold tamarind for Rs 6 per kg

as against Rs 2-3 per kg hitherto. The training pro-

gramme under the project as well as frequent visits by

NGO personnel, Bankers and NABARD officials have

enhanced awareness level among the people of this

inaccessible area. They have succeeded in presenting

their problems before the district authorities and get-

ting their work done.

There was a campaign against alcoholism in Sikerguda

to Maltipadar villages by the women SHG members in

December 2007.

All women members are covered under Swasthyashree

Health Insurance Scheme run by women federation

Banashree Mahila Sangathan supported by Antodaya.

Chhattisgarh (Kanker and Bastar district)

To promote Grain Banks among the SHGs in the mono crop

areas of the state, a project on pilot basis for establishment

of five grain banks each in two villages of Bastar division was

sanctioned by NABARD with matching grant contribution

from Catholic Relief Society, an NGO. As per the project in

Markatola village of Kanker district, each grain bank was to

cover 3 SHGs involving 50 members for mobilising 50 kgs of

grain by each member. In the Mylibeda village of Bastar dis-

trict, each grain bank was to cover three SHGs involving 15

members each in mobilising 30 kgs of grain per year by each

member. NABARD had sanctioned Rs 2.375 lakh as grant

assistance towards 50% cost for establishment of 5 grain

banks each in the proposed two villages belonging to tribal

communities over a period of 2 years from the date of sanc-

tion i.e. 17 February 2005.

Markatola village

The village has about 400 households having population

of 2,200 scattered in 9 hamlets. About 50% of the house-

holds are tribals and depend on agriculture and wage

labour. Villagers largely reside in kuttcha mud houses.

The land holdings of the families vary between 1.5 to 4

acres. Only one major crop i.e. Paddy is grown in a year.

About 35% of the families avail crop loan from LAMPS

which is around 10 km away. The nearest bank branch to

the village is 2 km away.

Achievement

The NGO had introduced the Grain Bank among the vil-

lagers long back. Only problem faced was that of limited

storage space restricting the operations of the Grain Bank.

Five Grain Banks were completed, of which four were

April 2009 | MICROFINANCE WORLD

17

[

COL

UMN

]

constructed in community and panchayat land and the

remaining one in the land donated in writing in Gram

Panchayat forum by the land owner. The Grain Banks are

managed by a committee and secured with lock and key

under joint custody. The Grain Banks started functioning

with effect from March 2007. An extension worker of the

NGO staying in the area oversees the functioning of the

Grain Bank.

SHGs are base for all the Grain Banks. Members of 3 to 4

SHGs are the members of each Grain Bank. All the SHGs

associated with the Grain Banks were gathering grains at

uniform rate of 5 kata (15 kgs) per member after harvesting.

Mylibeda village

The village has about 200 households having population

of 1,500 scattered in 7 hamlets. About 95% of the house-

holds are tribals and depend upon agriculture and wage

labour. The average size of land holding of the households

is 4 to 5 acres. Only one crop i.e. paddy is grown in a year

as the village depends entirely on rainfall for cultivation.

The village is having one Anganwadi Centre and one pri-

mary school. Catholic Relief Society, the NGO has imple-

mented a watershed programme in the village. A residen-

tial school upto 10th Standard and a hospital are run by

the NGO in the village.

Achievement

14 SHGs were formed in the village and it was observed

that members were aware of the SHG concept and had

opened SB A/c with the RRB branch. The groups had

mobilised Rs 5 to 10 per month regularly. The Grain Banks

started functioning with effect from 1 December 2006. All

the grains contributed during 2006-07 was lent out.

The establishment of Grain Banks in the village

addressed the problem of resorting to the money lenders

by the villagers to a large extent. Because of Grain Bank, vil-

lagers remained united. They also organised recreational

activities in the village. Grain bank activity helped the vil-

lagers to organise and construct a check dam in the nearby

nala. They are now able to produce second crop on some

additional plots. Grain Banks have helped villagers in

developing close association with the NGO and getting

easy access to high school education and health facilities.

Learnings

Monetising the savings in kind

: The objective of monetis-

ing the savings in kind was achieved to a great extent in

Orissa. Bank loan routed through the NGO took into

account the savings in the form of grain while working out

the corpus of the group. The branch of the erstwhile

Kalahandi Gramya Bank (presently Utkal Gramya Bank)

could bring 364 household under its purview in one of the

most inaccessible areas of the Kalahandi district. The

SHGs of remaining part of the area i.e. Kerpai GP were also

credit linked through the effort of another NGO,

Shahabhagi Vikash Abhiyan and DRDA/ORMAS. Thus the

entire area could be brought into banking network. The

flexibility i.e. the repayment and distribution in any mode

of grain (either in the form of rice, paddy, pulses) led to

converting the produce of the area into money, facilitated

savings in grain, credit in the form of grain as well as cash.

Building synergy between SHGs and Grain bank

: The

synergy between Grain Banks and SHGs has brought in a

decentralised system for distribution and recovery with

the involvement of the community. This has led to the sus-

tainability of the Grain Bank.

Food Security And Participatory Management

: Food

security during the food stress period was the biggest chal-

lenge which has been addressed successfully as the people

could meet their requirement through Grain Bank.

Other developments:

The implementation of OTELP and

construction/repairing work of road are the major develop-

ment initiative by the Orissa Government. The develop-

ment work led to flow of grain and cash in the form of wages

and grant assistance for various livelihood programme.

Future Strtaegy

Grain Bank to be converted into commodity outlet :

The

tribals of the projects wanted to continue with the Grain

Bank scheme. The community is in the habit of saving and

the grain saved at the SHG level could be used for access-

ing funds from bank. The stock of grain with SHGs in vil-

lages may ensure food security particularly in the context

of food stress period during monsoon when the area gets

cut off. The Grain Bank can be converted into commodity

outlet and may be linked to the rural haat.

Grain Bank Committee to become Farmers club:

The

Grain Bank Committee may gradually become inactive

with less work in hand and may ultimately become

defunct. In order to enrich the job of the Grain bank com-

mittee and bring some integration for agriculture develop-

ment on a permanent basis Farmers club may be consti-

tuted in which the members of the grain bank committee

may become member.

Replication in other states

: This model of association of

Grain Bank with SHG bank linkage is relevant particular-

ly in remote inaccessible pockets of the country for bring-

ing such regions under the purview of the banks with sup-

port from NGOs.

The writer is AGM, NABARD

MICROFINANCE WORLD | April 2009

18

[

COL

UMN

]

GOURI SHANKAR

S

tandard Chartered Bank's (SCB) engagement with

the development agenda is core to its focus on build-

ing a sustainable business. We believe that our long

term financial performance is dependent on having the

right social and environmental conditions for growth in

our markets. By engaging with our stakeholders we have

identified seven key areas where we can make the greatest

difference access to financial services is one of them.

Across Asia, Africa and the Middle East we provide a

customized product offering for all stakeholders in the

microfinance industry including: local currency lending

and banking products and services to our microfinance

institution (MFI) partners, risk participation structures

with development organisations, technical assistance (TA)

linkages with TA providers and global markets products for

international investors.

In September 2006 the bank announced its commit-

ment at the Clinton Global Initiative to establish a $500

million microfinance facility over a five-year period. In

view of the lean branch network of the bank, SCB follows

the wholesale model of bulk lending to MFI for further on

lending to the Self-Help Groups (SHGs)

and individuals. This facility will pro-

vide MFIs and fund managers with $500

million of credit, financial instruments

and technical assistance to finance

MFIs in Asia and Africa.

In India as on March 9, the bank had

an outstanding portfolio of $60 million,

with an outreach of about 0.75 million

clients spread across 15 MFI partners, a

majority of whom had a pan India pres-

ence. Our partners include a mix of

established intermediaries, urban start

ups and down-scalers. Products offered

include: term loans, overdraft limits and

cash management facilities. Over the

past year in particular, given the sizeable

growth in the operations of our partners

we have begun to support them in linking into the investor

community via the capital markets.

The bank views this as a channel for empowerment of

women and people at the bottom of the pyramid. With a

view to achieve scale, bank's microfinance business is sus-

tainable in nature with ample scope for expansion. With

millions of financially empowered client base created

through microfinance business, there are many other

business opportunities in the domain of micro savings,

micro pension and microinsurance etc. Except for micro

credit, the other financial products have not really reached

the clients and there lies new opportunities and chal-

lenges for banks and financial institutes.

Beyond building the business, the bank also invests in

the capacity of its partner MFIs through technical assis-

tance and trainings. Over the past year the bank has

invested in two training programmes for the microfinance

sector in India.

Though MFIs are improving their risk mitigation strate-

gies with growth, still there is scope for improvement and

the enhanced risk systems does not appear to commensu-

rate with the growth. With a view to contribute in this

important space, bank is trying to down scale its robust

risk management frame work to suit to

the MF industry and provide as a sec-

toral offering for the benefit of the

industry. The bank is working a

renowned industry training agency to

undertake this project.

The Indian microfinance sector mir-

rors the global microfinance sector in

terms of its development. The sector is

highly concentrated and a small number

of MFIs manage the majority of assets. In

a bid to develop new investment oppor-

tunities in the sector, we sponsored, for

the second time in two years, "SRIJAN", a

microfinance business plan competition

aimed at encouraging greenfield MFIs.

The writer is head Microfinance,

Standard Chartered Bank

April 2009 | MICROFINANCE WORLD

19

[

COL

UMN

]

LEADING THE WAY

Standard Chartered provides financial services credit, savings, banking products

and services to its Micro Finance Institution (MFI) partners across Asia, Africa and

the Middle East

Though Microfinance

Institutions are

improving their risk

mitigation strategies

with growth, still there

is scope for improve-

ment and the

enhanced risk systems

does not appear to

commensurate with

the growth

You have been with the main street banking industry

for almost 22-23 years. What brought you here to

microinsurance?

I was really excited by the opportunity in this market.

There are two things: One is sheer opportunity of the busi-

ness to transform life and really impact a poor person's life.

I come from South and my grand parents still live in a vil-

lage. So, I know what all adversities people go through

there. I was always very passionate about doing something

in this area.

In fact, when I was with the Barclays we tried making an

arrangement with SKS for mobile banking or tele-payment

facility. We were running a pilot then, but it didn't work

out then.

On the commercial front, we have a huge scale already.

We are the biggest microfinance company in India. If we

continue to grow at the same pace, we are hopeful of

becoming the largest microfinance company in the world

within next two years. Per month we are adding 2.5 million

customers and are targeting 15 million customers by the

end of financial year 2012.

What has been the most interesting experience for you in

SKS microfinance till now?

The way microfinance has changed the lives of poor peo-

ple is simply amazing. There are a lot of people I meet

who have taken loans from us and changed their lives.

However, there is one case that I remember quite vividly.

During one of my visits to the centres in Andhra Pradesh,

I had met a widow. She was then in the second cycle

of loan from SKS.

Before joining the SKS family, she used to work as a

labourer near her place and earned on per hour basis.

After her husband's death, she took a loan from SKS

Microfinance to buy a sewing machine and started sewing

clothes. Within one year, she managed to increase her

business two-fold and bought another sewing machine.

Apart from elevating herself, she employed other labour

class as well and helped increase employment opportuni-

ties in her area.

We also met her daughter and she spoke to me in

English. I was surprised! Then later the woman told me

that she supported her family and ensured good education

for her daughter. After completing her graduation, she was

then working in a call centre.

A loan from SKS elevated that widow from labour to

entrepreneurial class. There are many more cases where

women in dire conditions have taken loans from us and are

now proud owners of their small entrepreneurial set up.

People always question microfinance and doubt if it is

doing well or not. I'm totally convinced. We are not only

doing well but also making sure several people that are in

need too are doing well.

Besides disbursing loans, you also teach the borrower

how to write her name. Why?

We generally conduct three-day session before the loan

disbursement. In these sessions, women are told how the

whole microfinance set up works. We also teach them how

the interest is calculated, what the total amount that they

`WE HAVE BEEN GROWING AT 200%.

BY 2009 END WE SHOULD HAVE OVER

60-65 LAKH CUSTOMERS'

Suresh Gurumani took over as the CEO of SKS Microfinance last year after Vikram

Akula, the founder of SKS, stepped down to become a full-time director on the board

of the company. A banking veteran with 22 years of experience has set a clear

growth path for his company even during these times of slowdown. In an exclusive

chat with Suneeti Ahuja, Mr Gurumani shares his experiences working in the field of

microfinance. He outlines his plans of making SKS one of the largest microfinance

company and hopeful of targeting 15 million customers by 2012.

MICROFINANCE WORLD | April 2009

20

[

INTERVIEW

]

will be paying is and most importantly, how to write their

name. It instills a lot of confidence in the person.

Besides, whenever a woman takes loan from us, we

make sure that the respective husbands and families know

about the step. And finally, at the time of loan disbursal,

both husband and wife have to sign the document.

In fact, I remember an incident. On one of the loan dis-

bursal days, there was a couple that had come. After taking

the loan, they had to sign on the papers. Now the husband

wasn't literate and put his thumb impression on the paper

and the wife on the other hand, since she had gone

through that training program, took a pen and signed. We

could see the sense of pride in that act -- she felt superior

to her husband.

These are small things but have a very deep social

impact. One factor is the group part. Since we lend only to

groups of women, it binds some sort of binding to the soci-

ety as a whole. And that is lacking in the street banking.

How do you categorise poor people for disbursement

of loans?

We have divided them into three classes: upper poor, very

poor and ultra poor. While we disburse loans to the first

two segments, we give grants to the ultra poor. Say,

Rs 20,000 to buy a cow and then we teach them how to

feed and milk the cow and earn some money. We want to

make them commercially viable. So that is again a pilot

that is running. These are basically people who have

income of less than $1 per day.

We are also working with Forbes on a project to ensure

some sort of entrepreneurial opportunity for this segment.

You do not ask for any collateral at the time of loans.

What is the default rate and who are your customers?

Most of the people that take loans are migrants. This is a

business that is purely driven on trust. The group model

makes it really successful. We make groups of five and dis-

burse the loans to them. One important point is that the

members of the group should not be blood relatives. Then

it is the responsibility of the group to ensure that all the

members pay their due instalments in time. In case some-

body defaults then the group has to pay for that person.

So far we have had recovery rates of almost 100% even

in state of Bihar, where people might think we would have

problems. Our recovery rate is 99% per cent.

Disbursal of loans is done after all the due diligence

from our side.

You are a profit making organisation. What is the

turnover for the company last year?

Financial figures are confidential. In terms of growth, we

have been growing at 200%. In India, right now we have

close to 40 lakh customers, which should be over 60-65

lakh by the end of this year.

April 2009 | MICROFINANCE WORLD

21

[

INTERVIEW

]

Are there any bottlenecks that you face in this industry?

There are two types of challenges that we face: internal

and external challenges. Let me first talk about the internal

challenges. The first one is rural connectivity. We set up

branches and then need to make sure that the information

is reaching those branches in time. But now with the

broadband connections being available almost every-

where, this problem is being resolved pretty fast.

The other challenge is people. We have a branch head

and then other people that facilitate the whole process.

And we make it a point to employe the localities. Most of

the people working or heading these areas are 10th pass.

We ask for references from the local people and based on

the references, we fill the vacancies. We strongly believe

that there should be an empathy with the customers.

On the external challenges front, we have bureaucratic

hurdles. As a company, we have set principles that we are

unwilling to give in. So it takes a lot of time at times to open

a new branch. Then lending from banks is also a concern.

Although, the condition is better off now, Vikram Akula, the

founder and now the chairman of SKS Microfinance faced a

lot of problems. Most of the banks were not ready to lend

then, as they could not figure out how we could lend with-

out collaterals and give unsecured loans. And now, we are

the biggest borrowers from the banks.

Then there are problems like Naxalism.

What is the rate at which you borrow from the banks?

And what is the rate of disbursal?

Currently, we are borrowing at 13.5%. We give the loans at

the rate of interest of 24% to 28%.

Why such a difference in interest rates?

There are two costs involved in this business: one is the

operating cost and second cost is interest cost. Since, we

have to go far flung areas to do everything, it incurs a lot of

operating costs. And then we have to take care of the inter-

est part as well.

To take care of all the costs, we charge the borrower as

per the higher slabs. But as we scale up and bring our costs

down, we tend to reduce the rate of interest charged as

well. Like in Andhra Pradesh and Karnataka, we charge

12.5% as the member base is high, where as in areas where

we are yet to reach the critical mass we charge 15%. And in

turn, pass on the benefit to the customers.

Are there any other initiatives that you are working on

for this segment?

There are quite a few initiatives that are underway. In

terms of rural reach, we have about 1,400 branches. What

we are looking at is a holistic rural economy. While micro-

finance is one way, through the reach, we are planning to

introduce good-quality products to the rural masses.

For instance, we have a pilot running with Unilever for

supplying water purifying systems. Through these sys-

tems, the poor get access to clean drinking water. We have

a special arrangement with the company that poor people

to pay for these systems in installments. Thus, we are try-

ing to provide access to better life to the poor through our

wide reach.

We already have a pilot project running in Andhra

Pradesh and Orissa. Soon we should be able to launch the

services everywhere. We are also running another project

on solar light.

We look at products that are good for the customers. And

we bundle the finance option for the customers. For exam-

ple the water purifier is for Rs 1,800 and the solar light is

between Rs 1,250 to 1,800. We are also planning to roll out

another set of services mobile. We have tied up with Airtel

and Nokia for this. Besides the business part, these can also

be used by the families.

You have grown to quite a significant level. Going for-

ward would you also look at other types of loans and also

expand the reach to men as well?

First, we give loans only for entrepreneurial work and have

no plans to increase this to other types of loans.

And why only women? That is because I think women

are more risk-averse. As they are the ones who handle the

household expenses, they are more responsible with the

loans. We feel there is still huge opportunity in this area.

And therefore, would not want to widen our reach in terms

of men borrowers right now.

Are you planning to expand overseas as well? And if yes,

where do you see the opportunity?

We cannot say anything right now. But yes, there are

opportunities in China and Far East.

MICROFINANCE WORLD | April 2009

22

[

INTERVIEW

]

There are quite a few initiatives that are underway. In terms of rural reach, we have

about 1,400 branches. What we are looking at is a holistic rural economy. There are

quite a few initiatives that are underway. In terms of rural reach, we have about

1,400 branches. What we are looking at is a holistic rural economy

AJAYA MOHAPATRA

S

ince the beginning of the global eco-

nomic downturn in mid-2007, the

world is debating what would be the

impact of financial crisis on the microfi-

nance (MF) sector. MF has emerged as one

of the pivotal strategies across the globe for

alleviating poverty by enabling poor to

raise their income and socio-economic sta-

tus. The history suggests that since last two

decades microfinance institutions (MFIs)

are largely resilient to the financial crises.